New AEB White Paper on customs procedures with economic impact

Jun 18, 2013

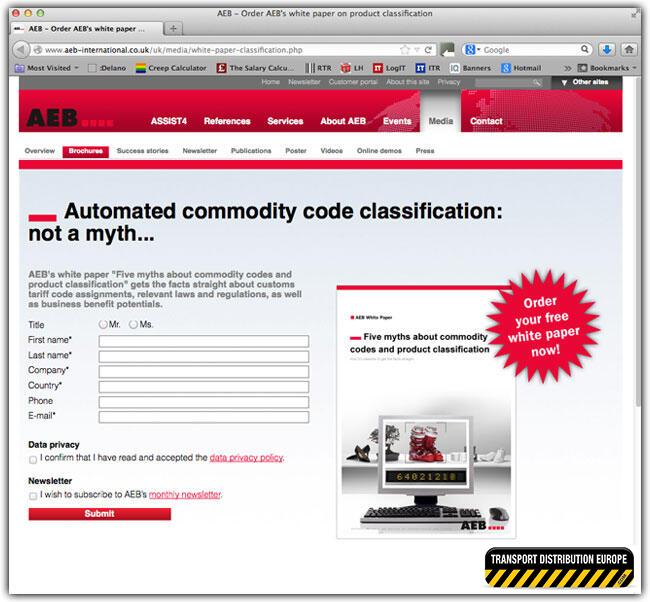

Incorrect product classification can have severe consequences and businesses are well advised to incorporate error-minimizing measures into their risk management strategy. SCM solutions provider AEB (International) dispels the most common myths about product classification requirements, importers' obligations and available solutions in its latest white paper "The five most common myths about commodity codes and product classification". The white paper can be downloaded free of charge, without obligation at www.aeb-international.co.uk/classification.

Cars, machinery, electronics, chemical products, and even daily consumer goods such as coffee, food, and textiles: all goods moving within the EU and all goods traded with "third countries" outside the EU are assigned to "commodity codes". They are defined in the Combined Nomenclature (CN), which is even applicable outside the European Union: countries such as Turkey that have bilateral trade agreements with the EU also use the CN.

Commodity codes represent the key classifier in international trade, and they carry more weight than many suspect: they determine import duties for example, but also import and export restrictions, as well as licensing and documentation requirements, and they also play a key role in the authorisation of simplified customs procedures.

For many globing trading companies, product classification in accordance with the CN and global trade laws and regulations is a tedious and time-consuming task. Manually classifying products requires sifting through a nomenclature of 21 sections, 96 chapters, and over 5,000 subheadings to find the right code. Classifying goods and assigning the right commodity codes is typically a complicated and time-consuming process that requires a high level of expertise.

Although the significance of commodity codes is beyond question, they are frequently disregarded or underappreciated in day-to-day business. AEB's latest white paper dispels common misconceptions, explains background information and legal requirements, and introduces solutions and business benefits on this complex topic.

Individual numbers and combinations of numbers in the commodity code have specific meanings: In general, exports require an eight-digit commodity code or CN code. This is uniform throughout the EU. Imports are subject to additional regulations based on national law, such as those governing the value-added tax on imports. That's why imports require a ten-digit (or, in some countries, 11-digit) commodity code known as a customs tariff code.

These eight to eleven digits that make up the commodity code have quite an impact on businesses. Misclassification can mean that companies pay too much import duties – if they're lucky – or, in the reverse scenario, they may be guilty of tax evasion. Misclassification can also result in unauthorised exports with corresponding penalties and export bans. Clearly, ignorance of the law is no excuse.

AEB's white paper examines and clarifies the following common misconceptions:

- The commodity code is not all that important. We only export.

- We've already assigned commodity codes to our products – that should do it.

- The responsibility for classifying new goods lies with someone else – it's not my problem.

- There isn't any commodity code that matches our products, so there's no point in looking.

- Even if the commodity code is in the enterprise-wide ERP system, each country must classify products on its own

The free white paper also introduces AEB's classification software, ASSIST4 Classification. The new solution is part of AEB's Customs Management Suite and facilitates the correct assignment of customs codes, enabling largely automated and fast product classification through self-learning algorithms to ensure correct and compliant export and import management while saving time and costs.